Federal Firearms Licenses (FFL) in 1938: Simple, Cheap, & Shall Issue

The precursor to the Federal Firearms License (FFL) required by the Gun Control Act of 1968 (GCA1968), was the Federal Firearms License required by the Federal Firearms Act passed in 1938. The Federal Firearms Act of 1938 is not the National Firearms Act (NFA) of 1934. The NFA of 1934 is an act requiring taxes and registration for machine guns, short barreled shotguns (sbs), short barrelled rifles (sbr), silencers, and an “any other weapon” for firearms that do not look like firearms.

The Federal Firearms Act (FFA) of 1938 was an act that required people to have a license to ship and receive firearms, ammunition components, and pistol ammunition, except for .22 rimfire, across state lines and international boundaries for commercial purposes. The fee for a manufacturer was $25 and for a dealer was $1.

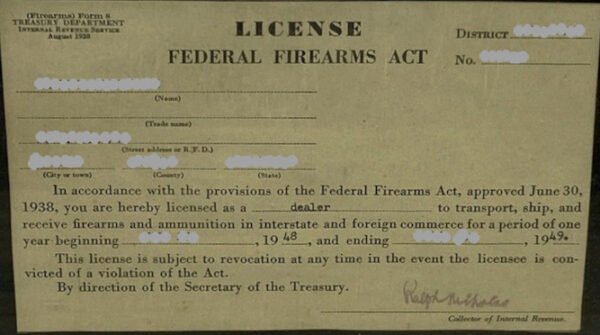

The license required for a dealer under the FFA is a direct precursor to the Federal Firearms License required today. Both were/are requested on a Form 7. Both were/are issued as a Form 8.

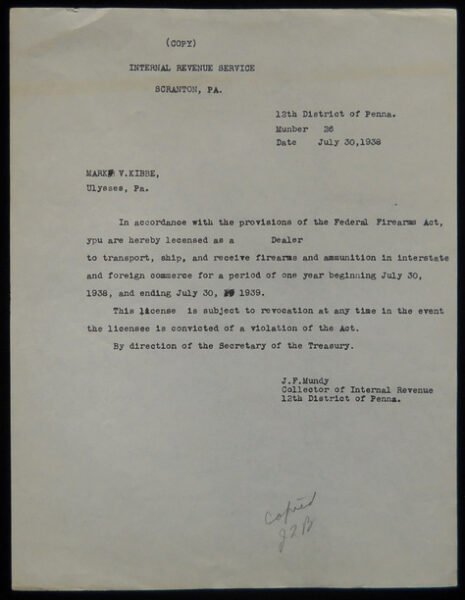

Before the Form 8 was issued in August of 1938, people wanted a license to bridge the gap from the time the FFA went into effect until the Form 8 became available. It appears the gap was for one month, starting on July 30th, 1938. The Form 8 was issued in August 1938. Form 8 has been modified extensively over the years. A few very early FFLs were issued by letter. The wording is very similar to that of Form 8. Here is an image of a sample letter in Pennsylvania.

Application for a license was sent to the collector of income taxes for the local district of the Internal Revenue service. There were 64 Internal Revenue districts in the United States, including territories, in 1938.

The license issued under the FFA was good for one year and had to be renewed each year. It was issued to a person and was good wherever that person did business. A primary business location was requested, but some licenses were issued with a P.O. box as an address. Records of transactions were required. If firearms had serial numbers, the serial numbers were recorded. Records were required to be kept for six years. Licenses were “shall issue”. If the requester met the minimal requirements, the license had to be issued. One of the requirements was that the requestor had not been convicted of a crime of violence. Ten crimes were defined as meeting the criteria. From Title 26 of the IRS, 1939:

The term “crime of violence” means, murder, manslaughter, rape, mayhem, kidnaping, burglary, housebreaking; assault with intent to kill, commit rape, or rob; assault with a dangerous weapon, or assault with intent to commit any offense punishable by Imprisonment for more than one year.

“Interstate commerce” meant selling, buying or shipping across state lines or international boundaries for a business purpose. The term had not been ballooned to include nearly everything as it has been today. A requirement of the license was local and state laws had to be obeyed.

Violating the provisions of the act or knowingly supplying false information to obtain a license was punishable by a fine of $2,000 or imprisonment for five years. If a license was revoked for cause, a person had to wait for two years before they could reapply for another license. In 1938, a dollar was worth 1/35 of an ounce of gold. Many obtained the licenses out of necessity or convenience. In 1939, the Commissioner of the Internal Revenue recorded that there were 32,847 licenses. Because the licenses had to be renewed every year, the numbers dropped considerably during World War II. In the 1950s, they regained their former numbers. The number of licenses issued under the FFA in 1951 was 31,203. The IRS transferred the administration of the NFA and the FFA to the Alcohol Tax Unit of the IRS effective on April 1, 1951. This correspondent has not found a report of the number of FFL licenses issued after 1951.

This correspondent recalls that his pastor, about 1965, said he had obtained an FFL to make direct purchases across state lines easier. Many gas stations and small stores sold firearms and ammunition for cash. Many of them had FFLs. The dollar fee was not burdensome in the 1960s, and the license was easy to apply for and obtain. Many people obtained a license for a year or two, then allowed it to lapse. The last year the FFA was in effect was 1968. In 1968, 36,050 firearms records were checked at dealers’ premises. How many licenses had been issued under the FFA has not been found. It would not surprise this correspondent if the number were in the hundreds of thousands.

In the IRS report for 1969, 77,573 new Federal Firearms Licenses were issued during the last days of 1968 and the first six months of 1969, to comply with GCA 1968. This is likely a fraction of the licenses issued under the Federal Firearms Act. The license required by GCA 1968 costs $10 per year and imposes more burdensome record-keeping. The Commissioner of the IRS, in the annual report for 1970 (June 30, 1970), stated materials were developed to inform 200,000 target shooters and 100,000 collectors of their responsibilities under GCA 1968. It is unknown if these numbers are indicators of how many licenses were issued under the FFA. The IRS listed the numbers in their report. This indicates the IRS believed there was a connection. In 1971, the IRS reported that it processed 150,000 firearms dealer licenses a year. It seems likely that the number of dollar-a-year FFL licenses issued under the FFA in 1967 or 1968 numbered at least as many.

There is no reason to believe the FFA of 1938 had any significant impact on crime. The act was administered under the Internal Revenue Service because the Roosevelt administration considered the administration of a tax as a viable way to “get around” the prohibitions of the Second Amendment. The Roosevelt administration knew they had the power to tax, but not the power to infringe on rights protected by the Second Amendment. Courts have since ruled that Constitutional rights cannot be singled out for selective taxation.

About Dean Weingarten:

Dean Weingarten has been a peace officer, a military officer, was on the University of Wisconsin Pistol Team for four years, and was first certified to teach firearms safety in 1973. He taught the Arizona concealed carry course for fifteen years until the goal of Constitutional Carry was attained. He has degrees in meteorology and mining engineering, and retired from the Department of Defense after a 30 year career in Army Research, Development, Testing, and Evaluation.

Leave a Reply

You must be logged in to post a comment.